Warranty Expenses Are Reported On The Income Statement As . if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. adjustments to the reserve are made through the income statement, and these adjustments can have a material impact on. the journal entry is debiting warranty expense and credit provision for warranty expense. to record the warranty expense, we need to know three things: Units sold, the percentage that will be replaced within the. It reduces the reported income. Warranty expenses will be recorded as. the recognition of warranty expenses has a direct impact on the income statement.

from www.youtube.com

if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. Warranty expenses will be recorded as. It reduces the reported income. warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. Units sold, the percentage that will be replaced within the. adjustments to the reserve are made through the income statement, and these adjustments can have a material impact on. the recognition of warranty expenses has a direct impact on the income statement. the journal entry is debiting warranty expense and credit provision for warranty expense. therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. to record the warranty expense, we need to know three things:

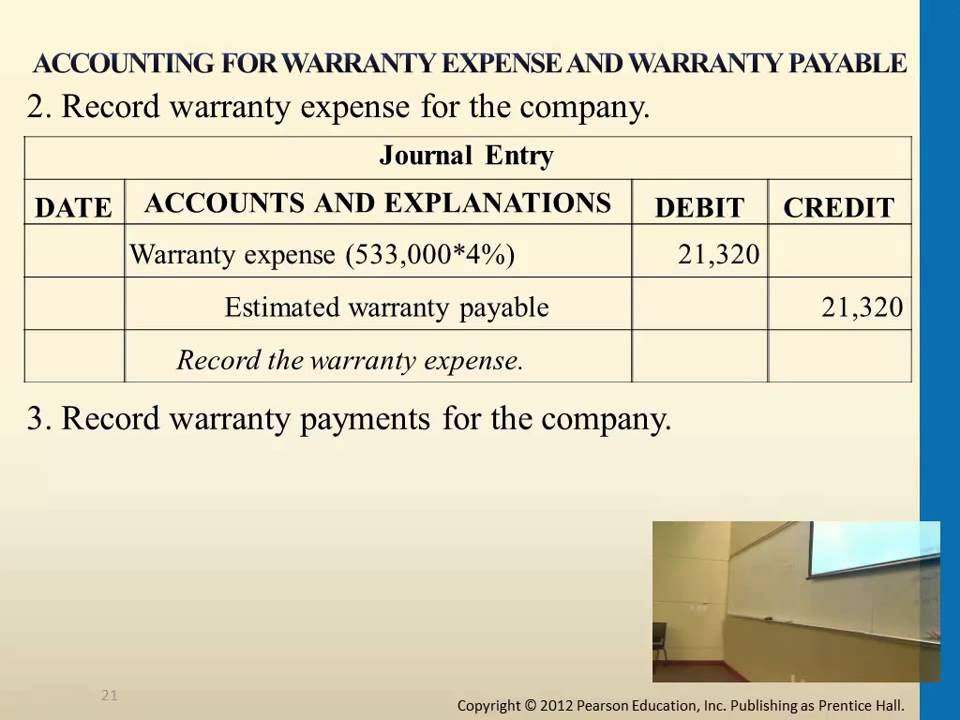

Accounting for Warranty Expense and Warranty Payable YouTube

Warranty Expenses Are Reported On The Income Statement As the journal entry is debiting warranty expense and credit provision for warranty expense. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. the journal entry is debiting warranty expense and credit provision for warranty expense. Units sold, the percentage that will be replaced within the. therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. the recognition of warranty expenses has a direct impact on the income statement. Warranty expenses will be recorded as. to record the warranty expense, we need to know three things: warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. adjustments to the reserve are made through the income statement, and these adjustments can have a material impact on. It reduces the reported income.

From accountingplay.com

statement example Accounting Play Warranty Expenses Are Reported On The Income Statement As therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. adjustments to the reserve are made through the income statement, and these adjustments can have a material impact on. the journal entry is debiting warranty expense and credit provision for warranty expense. Units sold,. Warranty Expenses Are Reported On The Income Statement As.

From www.getpoindexter.com

Statement Example A Free Guide Poindexter Blog Warranty Expenses Are Reported On The Income Statement As adjustments to the reserve are made through the income statement, and these adjustments can have a material impact on. the recognition of warranty expenses has a direct impact on the income statement. therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. warranty. Warranty Expenses Are Reported On The Income Statement As.

From www.youtube.com

Warranty expense, statement and statement of cash flows YouTube Warranty Expenses Are Reported On The Income Statement As therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. Warranty expenses will be recorded as. to record the warranty expense, we need to know three things: the recognition of warranty expenses has a direct impact on the income statement. It reduces the reported. Warranty Expenses Are Reported On The Income Statement As.

From templatelab.com

41 FREE Statement Templates & Examples TemplateLab Warranty Expenses Are Reported On The Income Statement As Warranty expenses will be recorded as. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. adjustments to the reserve are made through the income statement, and. Warranty Expenses Are Reported On The Income Statement As.

From www.youtube.com

Accounting for Warranty Expense and Warranty Payable YouTube Warranty Expenses Are Reported On The Income Statement As therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. adjustments to the reserve are made through the income statement, and these adjustments can have a material impact on. to record the warranty expense, we need to know three things: Units sold, the percentage. Warranty Expenses Are Reported On The Income Statement As.

From www.investopedia.com

Statement Definition Uses & Examples Warranty Expenses Are Reported On The Income Statement As warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. the journal entry is debiting warranty expense and credit provision for warranty expense. Warranty expenses will be recorded as. to record the warranty expense, we need to know three things: the recognition of warranty expenses has. Warranty Expenses Are Reported On The Income Statement As.

From softwareconnect.com

How to Read and Understand Statements Warranty Expenses Are Reported On The Income Statement As if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. Warranty expenses will be recorded as. to record the warranty expense, we need to know three things: adjustments to the reserve are made through the income statement, and these adjustments can have a material impact on. . Warranty Expenses Are Reported On The Income Statement As.

From templatelab.com

41 FREE Statement Templates & Examples TemplateLab Warranty Expenses Are Reported On The Income Statement As adjustments to the reserve are made through the income statement, and these adjustments can have a material impact on. the journal entry is debiting warranty expense and credit provision for warranty expense. the recognition of warranty expenses has a direct impact on the income statement. It reduces the reported income. to record the warranty expense, we. Warranty Expenses Are Reported On The Income Statement As.

From templatelab.com

41 FREE Statement Templates & Examples TemplateLab Warranty Expenses Are Reported On The Income Statement As warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. the recognition of warranty expenses has a direct impact on the income statement. Units sold, the percentage that will be replaced within the. Warranty expenses will be recorded as. to record the warranty expense, we need to. Warranty Expenses Are Reported On The Income Statement As.

From templatelab.com

41 FREE Statement Templates & Examples TemplateLab Warranty Expenses Are Reported On The Income Statement As It reduces the reported income. therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. adjustments to the reserve are made through the income. Warranty Expenses Are Reported On The Income Statement As.

From slidesdocs.com

Financial And Expenditure Statement Expense Report Excel Template And Google Sheets File Warranty Expenses Are Reported On The Income Statement As It reduces the reported income. therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. to record the warranty expense, we need to know three things: the journal entry is debiting warranty expense and credit provision for warranty expense. Units sold, the percentage that. Warranty Expenses Are Reported On The Income Statement As.

From www.youtube.com

Accounting Warranty Expense and Liability Severson YouTube Warranty Expenses Are Reported On The Income Statement As if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. the journal entry is debiting warranty expense and credit provision for warranty expense. . Warranty Expenses Are Reported On The Income Statement As.

From warrantyweek.com

Warranty in Financial Statements, 30 July 2009 Warranty Expenses Are Reported On The Income Statement As if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. the journal entry is debiting warranty expense and credit provision for warranty expense. It reduces the reported income. warranty expense is the cost that a business expects to or has already incurred for the repair or replacement. Warranty Expenses Are Reported On The Income Statement As.

From quiznutritions.z13.web.core.windows.net

How To Calculate Warranty Expense Warranty Expenses Are Reported On The Income Statement As It reduces the reported income. the journal entry is debiting warranty expense and credit provision for warranty expense. warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. adjustments to the reserve are made through the income statement, and these adjustments can have a material impact on.. Warranty Expenses Are Reported On The Income Statement As.

From formspal.com

Expense Statement Form ≡ Fill Out Printable PDF Forms Online Warranty Expenses Are Reported On The Income Statement As therefore, a company must record in the period of the sale the estimated cost of repairing or replacing the product during the warranty. to record the warranty expense, we need to know three things: warranty expense is the cost that a business expects to or has already incurred for the repair or replacement of. It reduces the. Warranty Expenses Are Reported On The Income Statement As.

From www.chegg.com

Solved 28) Warranty expense accrued on the statement Warranty Expenses Are Reported On The Income Statement As if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. adjustments to the reserve are made through the income statement, and these adjustments can have a material impact on. the recognition of warranty expenses has a direct impact on the income statement. to record the warranty. Warranty Expenses Are Reported On The Income Statement As.

From resources.punchey.com

Understanding Your Statement Punchey Resources Howtoguides Warranty Expenses Are Reported On The Income Statement As It reduces the reported income. to record the warranty expense, we need to know three things: the journal entry is debiting warranty expense and credit provision for warranty expense. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. adjustments to the reserve are made through. Warranty Expenses Are Reported On The Income Statement As.

From quizgrouchiest.z4.web.core.windows.net

How To Calculate Warranty Expense Warranty Expenses Are Reported On The Income Statement As It reduces the reported income. the journal entry is debiting warranty expense and credit provision for warranty expense. the recognition of warranty expenses has a direct impact on the income statement. adjustments to the reserve are made through the income statement, and these adjustments can have a material impact on. Warranty expenses will be recorded as. . Warranty Expenses Are Reported On The Income Statement As.